It’s the April grain revenue management newsletter and this time we are going to discuss how using algorithms to predict grain revenue. As I mentioned in another newsletter, I do not think a whole lot of cash sales have been made against crops you are planting now. That means for all those long bushels you may have, there is no protection to falling prices until the crop insurance levels are hit. And then, it is based on the percentage of coverage you took. Here are the levels for 75, 80, and 85 collectively: 3.495, 3.728, and 3.961. With the Dec 24 futures at 4.73, should the market fall to these levels, not saying it will, but should it, you have a lot of revenue at risk.

Using Algorithms To Predict Grain Revenue

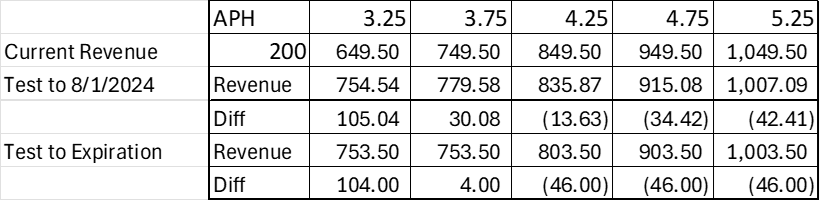

Let’s look at a purchase of put options as a potential mitigator of that risk. In modeling out our position, we assume that the probability of the market heading $1.00 higher is the same as heading $1.00 lower over the next few months. In other words, we really do not know and it is a 50/50 deal. The theory on put options is that you are willing to give up some revenue at the end of the day to provide revenue protection should the market head lower. The Black-Scholes model of option pricing is perhaps the best know options pricing method. (Black-Scholes is also incorporated in our revenue management algorithms.) Therefore, algorithm’s can be used to determine the impact of overall revenue based on market movement and time until the option expires against overall revenue. The following example highlights the decision making process that we use in managing revenue. Here is an example using an APH of 200 with the Dec futures at 4.75 and 50 cent deduct for local basis:

We will purchase December 450 corn puts expiring on 11/24/2024 at a cash outlay of $46 per acre. What does this transaction do to expected revenue?

Using Black-Scholes to test to August 1, at 3.25 Cash price, the options look to add 105.04 dollars per acre in revenue. At 5.25 cash, instead of making $1,049.50, options reduce this per acre revenue to $1,007.09. To give the added protection, is that difference not worth it? Let’s look at using options similar to a game plan for a football game. Often times, a team will script the first few plays from scrimmage. After those plays are over, the next play calls come based on what has happened with the first three. And then it continues throughout the game based on each situation. I contend that utilizing options in the revenue management process is not much different. We have this transaction in place and then wait to see what the market does.

Today, with this coverage in place, we will now wait to see what the market brings. Once we get a move to 3.75 cash or to 4.75 cash (which ever comes first), we look at the “play book” and determine what to do next. What will that be? That’s when we talk about things and come up with a solution that fits your needs.

*Option premiums discussed do not include the commissions and fees related to the transactions.

RISK DISCLAIMER: Trading in futures products entails significant risks of loss which must be understood prior to trading and may not be appropriate for all investors. Please contact your account representative for more information on these risks. Past performance of actual trades or strategies cited herein is not necessarily indicative of future performance.