Grain Revenue Management

The Heartland Hedging Process

“Living with what the market is giving you today and preparing for any market event that may occur.”

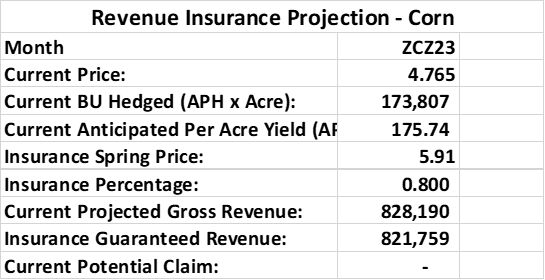

Current Scenario

| Inputs | ||

| Corn Acres Planted | 989 | |

| APH for Insurance | 175.74 | |

| Insurance Percentage | 80% | |

| Current Cash Sale % | 55% | |

Calculating the Insurance Threshold

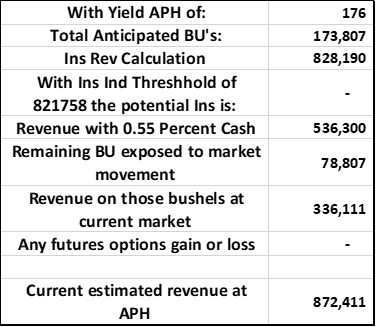

Calculating Current Estimated APH Revenue

The Mark to Market

THIS IS WHERE YOU ARE AS OF TODAY! WHETHER YOU LIKE IT OR NOT, THIS IS WHAT THE MARKET IS GIVING YOU. NOW, LET’S LOOK AT THE FUTURE

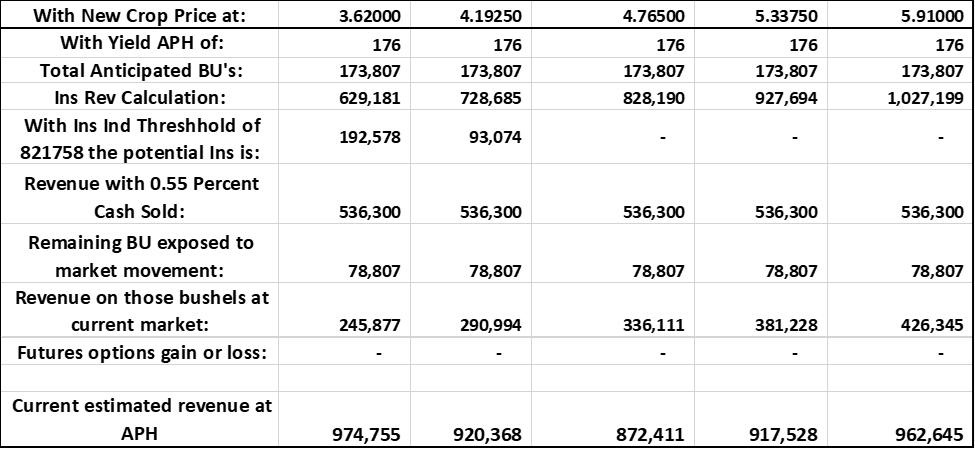

Markets go up and markets go down

How does this impact revenue?

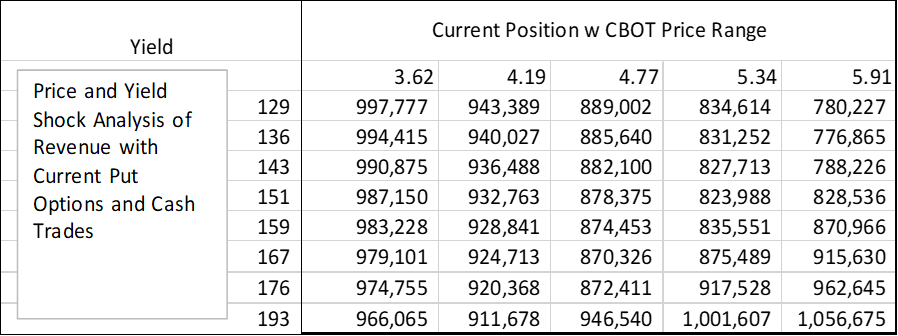

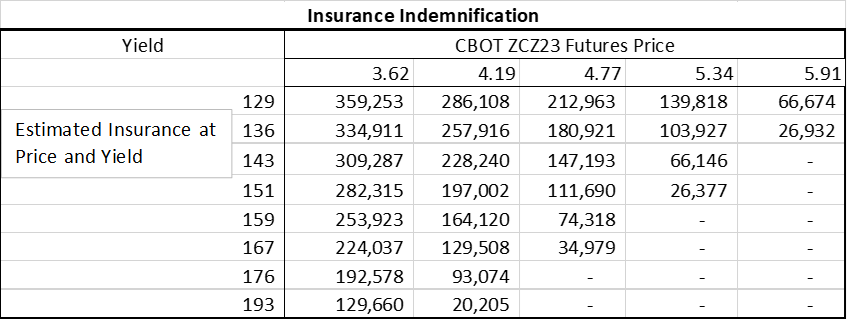

Reading the Matrix:

The current revenue is $872,411. Yet if the market were to head back to 5.91, your revenue would increase to 962,645. Why? Because your unsold bushels could be sold at those higher prices. If the market declines to 3.62, your anticipated revenue would increase because of insurance indemnification. Why is revenue at the lowest level currently? Because with 80% the price where indemnification enters is 4.728. (Take the spring price of 5.91 and multiply by the insurance percentage of 80% and the price is 4.728.) Because the market is trading near that threshold, any lower price movement triggers potential indemnification.

The next step in Grain Revenue Management is building a matrix providing a summary of anticipated revenue over an array of prices and yield changes. The revenue calculations include impact of cash sales, future sales of unsold bushels and any exchange traded options (there are none in this example).

The most dynamic component of revenue? Insurance indemnification.

WHERE DOES THAT LEAVES US?

As a grain revenue management consulting firm we review the array of different revenue scenarios. We determine what your expectations and tolerance to revenue volatility may be. These matrices demonstrate a small sample of our proprietary system that will help you become a revenue manager rather than a market speculator.

In this case our discussion with you might go like this:

- Your current revenue is $872,411. Where does this fit in with your budget and expectations? Good or bad, this is where we start.

- Do you have any idea where your final yield may end up? Because right now, your greatest risk is that your yield comes in at 80% of APH (143 BU/Acre) and the market goes back to the spring price by the time insurance claims are processed. Your revenue would decrease from $872,000 to $788,000.

- Our modeling will be able to test the result of adding options to your revenue management process before actually pulling the trigger on any trade.

- We can then work with you in understanding what the options may or may not due as you begin your journey on Grain Revenue Management.

What Else Heartland Offers

- Weekly reporting showing your mark to market revenue, and revenue changes in time and changes in market prices;

- Shock analysis of revenue based on all factors that contribute to gross farm revenue: Cash sales, insurance, and futures and options hedges;

- Reconciliation of futures account equity to hedges by crop by year.

Heartland Commodities and Securities Inc. is a National Futures Association registered Guaranteed Introducing Broker. John Ohman is a 30 plus year veteran of building hedge modeling to assist in quantifying financial risk across many industries. Some say he is a “hedgeaholic”. His models have been used for oil and gas, bond portfolio management, managing risks for mortgage originators, and grain producers. Today, his grain revenue management models can apply to any size farmer, large or small, to generate updates quickly.

There is significant risk involved in trading futures and/or options on futures. Futures and/or options of futures trading may not be suitable for all investors. Investors should consider these risks and evaluate their suitability based on their financial conditions. Past performance is not indicative of future results.