I would guess that you are getting close to getting seeds in the ground. Here in west central Minnesota, corn is just getting started. Both the corn and bean markets are pretty quiet, yet they both appear to be defensive. There are plenty of marketing firms and market guru’s that provide prognostication on where the markets could head and what you should do to help in managing your grain revenue in Minnesota. Sometimes the question is why is the market doing what it is doing? With 30+ years of experience in developing hedging strategies and algorithms, if I knew with certainty where a market is heading next, I would not be writing this today! If you are looking for one more opinion on managing your grain revenue in Minnesota, well, read on.

What Do The Numbers Say?

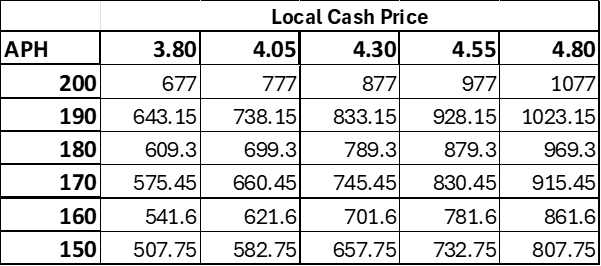

It is probably safe to say that there has not been much activity on locking in prices for the crop that you are getting ready to plant. I have put together a revenue matrix on corn that shows current revenue per acre based on APH numbers and an array of price movement on the December 24 corn futures. These projections are using a 50-cent local basis deduct from December 24 futures:

Are You Prepared For What The Market Bears?

This brings us to the first question we would ask our clients. That question is with the market at 4.30 cash, your per acre estimated revenue is “x” (find your number on the matrix!). Our question to you is this: If the market were to drop 50 cents per bushel and your per acre revenue falls to “y” (find your number on the matrix!).

Are you willing to live with that number. Yes or No!

- Did you answer yes? Guess what, you have just made your marketing decision! If prices drop by 50 cents per bushel, no matter what your APH is, your revenue will drop by 12% from current levels. By answering yes, I am OK, your decision was made before the market declined and knowing that your revenue declined by 12% should be no surprise. You may not be happy, but there should not be any surprise. Make sense?

- However, if your answer to that question is no, this is where Heartland hopes to become your partner in assisting you in managing your future revenue. We can give you alternatives and a second opinion. In the hedging world, there is not a whole lot that can be guaranteed.

Reach Out To Heartland Commodities & Securities

If you were to reach out to us for help on managing your grain revenue in Minnesota, I can guarantee one of two things: (1) That the strategies we employ, the reporting we provide, and the hedging algorithms, experience and expertise that we bring is far better than the timing of cash sales most marketers provide, or (2) the folks you are working with are the best in the business, have your best interests at heart and you continue in that direction.