We have no clue where the market will be come January, February, or even Dec 2025. What I can tell you is that today, Dec 2025 new crop corn is trading at 4.58. Looking back, I think that was the spring price in 2023. So though we cannot tell you where the market is going from here, what we can do is begin to estimate what your revenue may be when you shut down your combines in 2025. Here is how we are Hedging 2025 Corn.

- Many of you have an idea how many acres you may plant in next year. For our example, let’s use 1,000 acres;

- Nobody really knows what yields will actually be, but we can use an estimate or even your this years APH. For our example, let’s use 180 bu/acre;

- The current price for Dec 2025 corn is 4.5825 (this is the price all your potential buyers use to begin with!). For our example, we will use a 50 cent basis;

- Just with this tidbit of information, we can estimate your corn revenue today at $734,850.

- Yes the market will move, but at least we have a starting point;

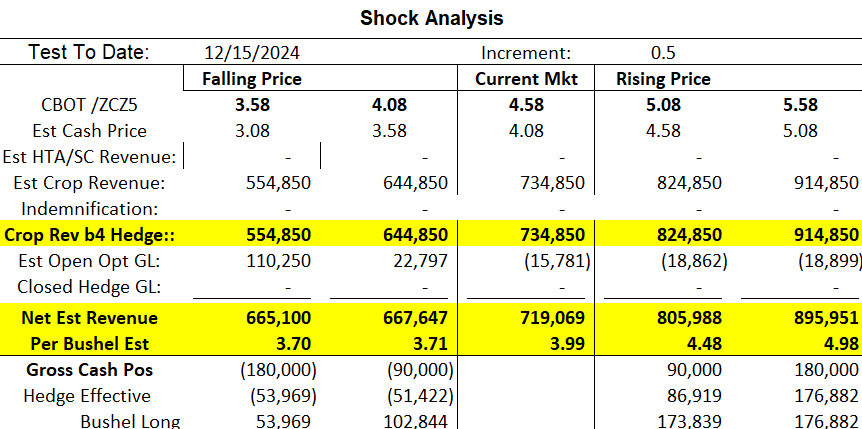

- With our proprietary shock analysis, we can show you what your revenue may be over a $2.00 corn price range

This shock analysis shows our estimated result by applying $19,800 from the marketing line your bank should provide to you. This $19,800 was used to purchase 180,000 underlying bushels of short dated new crop options expiring on 2/21/2025 with a strike price of $4.50.

Here’s the deal, if the market stays right here, yes going out to 12/15/2024 in time, those options will erode in price to where they are only worth $3,000. OK, not ideal. But tell me what the probability is of the market doing nothing for the next three months? Let’s look at the alternative. If the market drops 50 cents, those options that you paid $19,800 will be estimated to be worth $41,760. That is a gain of $21,892. Your crop lost value of $90,000, but at least you got some relief with estimated revenue of $667,647. But more importantly, because of the dynamics of option pricing, the next 50 cent move is estimated to capture $110,000 of the $180,000 loss on your crop. See how that works?

On the other side of the coin should the market rise 50 cents, instead of potentially capturing $90,000 of additional revenue on your crop, we estimate you capturing $71,000. If this were to happen, would you be upset? Knowing that on the downside you are building a revenue floor? This is why hedging 2025 corn is important.

At Heartland, we first consider ourselves revenue management consultants. However, because we are also a Guaranteed Introducing Broker registered with the National Futures Association, we must follow all the rules, regulations, policies and procedures placed on us as fiduciaries.

There is significant risk involved in trading futures and/or options on futures. Futures and/or options of futures trading may not be suitable for all investors. Investors should consider these risks and evaluate their suitability based on their financial conditions. Past performance is not indicative of future results.

One last point, once we put a corn hedging transaction in place, do we just wait to see what happens? The answer is no. This is the transaction that initiates our journey to managing revenue throughout the growing season. Things will change. Your acres may change, your yield estimates may change, we will see where the crop insurance spring price comes in and what you do with crop insurance before March 15. The market may move so that cash sales may be layered. All of these are changes that the revenue management process keeps updated that the mark to market and shock analysis will monitor. Our on going questions to you will always be “here is where we started, here is where we are today, here is where we may head tomorrow. Are you ok with how things look?” We continually monitor things as we move through time. We will provide recommendations to adjust the position that more closely resembles where you would like your revenue to be based on our discussions. Do you need to follow them? No. But we will toss the idea out and give you our reason why. It is up to you to say yes or no.

Want to know more? Our have us walk through hedging 2025 corn or other crops? Give me a call at 320-761-0406 or email [email protected].

Thanks for reading.